Why gold is still glittering in the eyes of investors…

Central banks, in particular, have been quietly diversifying away from US dollar reserves.

- Jo Groves

- 5 min reading time

Source: Trustnet

Gold has been on quite the tear, notching up nearly 70 all-time highs since the beginning of 2024 (and 30 of them in 2025 alone).

Over the past year, it’s delivered more than eight times the return of the S&P 500 and over a three-year period it has outperformed by more than 40 percentage points. Not bad for an asset that’s outlasted empires and pharaohs but still doesn’t pay a penny in income.

Of course, the million-dollar question is whether it’s too late to join the party or if the rally has further to run? So far, momentum continues unabated as investors turn to gold as a hedge against a perfect storm of macro headwinds: stagflation fears, geopolitical instability and, yes, the t-word.

What’s driving the rally?

It’s tempting to chalk gold’s rally up to panic buying by retail investors, given it has long served as a safe haven in times of volatility (and there’s been no shortage of that in recent months). But scratch beneath the surface and there are clear signs of a deeper structural shift.

Central banks, in particular, have been quietly diversifying away from US dollar reserves. This is driven not only by concerns over the ballooning US fiscal deficit and the risk of stagflation, but also by a desire to avoid falling into the crosshairs of Western sanctions. Not entirely surprising given that Goldman Sachs reports that the freezing of Russian assets after the Ukraine invasion triggered a five-fold surge in central bank gold buying.

These are not knee-jerk moves but part of a longer-term strategy to reduce reliance on potentially ‘weaponised’ US assets. China, for example, has doubled the share of gold in its reserves. Yet, with gold accounting for just 7% of China's total reserves compared to more than 70% for the US, Germany, Italy and France, there’s still plenty of headroom on that front.

Meanwhile, retail appetite shows little sign of fading, with gold ETFs chalking up five straight months of inflows as investors prioritise value preservation amid sticky inflation, slowing growth and volatility in equity markets.

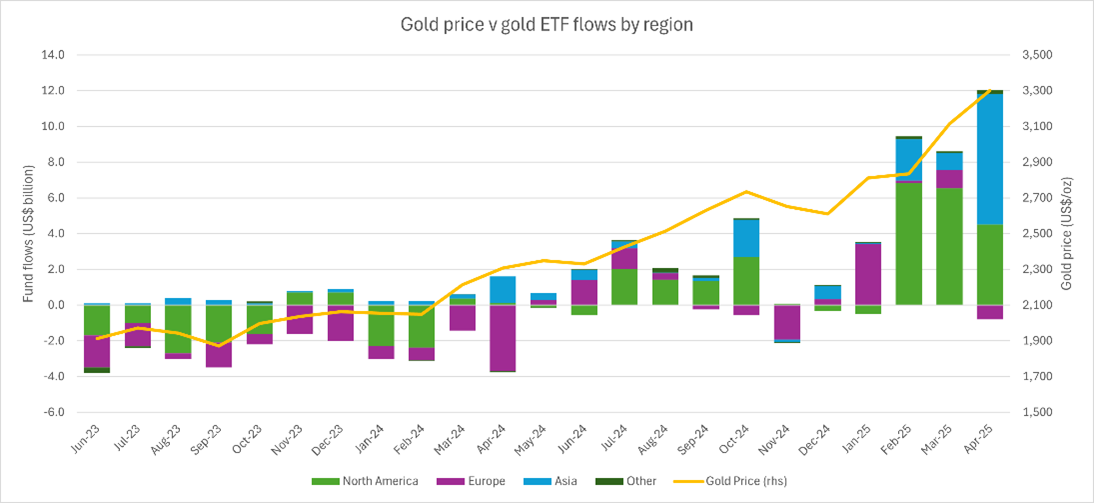

As the chart below shows, North American funds may have led the early charge, but inflows have now been surpassed by Asia. Chinese gold ETFs, in particular, enjoyed record inflows last month driven by trade tensions, falling bond yields and rising local gold prices.

Sources: Bloomberg, Company Filings, ICE Benchmark Administration, World Gold Council. Data as of 16 May, 2025

Can gold prices continue to climb?

Given the dizzying ascent of gold prices, investors may be cautious about buying at the top but analyst forecasts suggest the gold rally may still have legs.

Back in January, LBMA analysts projected an average gold price of $2,740 per ounce (oz) for 2025 with a ‘highest high’ of $3,290/oz. Both already look outdated given that gold broke an intraday record of more than $3,500/oz in April.

Goldman Sachs now sees gold hitting $3,700/oz by year-end, or as high as $3,880 in the event of a US recession. They point to continued central bank demand and steady ETF inflows underpinned by expectations of rate cuts and faltering growth.

Moreover, if traditional hedges such as US Treasuries continue to underperform during risk-off periods, even a modest rotation out of US assets could have a meaningful impact on gold prices.

Playing the angles

For those looking beyond a gold bar under their pillow (or a passive ETF), actively managed funds offer an interesting angle given that gold mining equities have so far lagged the rally in gold prices.

One standout performer is Golden Prospect Precious Metals, which has delivered a 48% share price total return over the past 12 months. This has been driven by high-conviction holdings in smaller-cap miners such as Ora Banda and Calibre Mining, where managers Keith Watson and Rob Crayfourd see compelling valuations.

They argue that if gold prices remain elevated and operational costs are controlled, rising earnings could support dividends, buybacks and even M&A activity. Despite its strong performance, it still trades at a c.25% discount to net asset value.

For broader exposure to metals, BlackRock World Mining Trust has around 30% allocated to gold alongside positions in copper and other industrial metals. It currently yields just under 5%, though performance has recently been weighed down by concerns over China’s economy.

That said, the trust is well-positioned to benefit from long-term structural drivers such as the energy transition and growth in AI-related infrastructure, both of which require vast quantities of critical minerals.

While gold’s trajectory can be difficult to predict, persistent geopolitical tensions and a mixed macro backdrop are likely to support continued demand both central banks and retail investors. Volatility is undoubtedly part and parcel of investing in commodities but for those investors with a long-term perspective, gold may still have plenty of shine left.

Jo Groves is an investment specialist at Kepler Partners. The views expressed above should not be taken as investment advice.

Important legal information

Bank of Scotland Share Dealing Service is operated by Halifax Share Dealing Limited. Halifax Share Dealing Limited. Registered in England and Wales No. 3195646. Registered Office: Trinity Road, Halifax, West Yorkshire HX1 2RG. Authorised and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN under number 183332. A Member of the London Stock Exchange and an HM Revenue & Customs Approved ISA Manager.

The information contained within this website is provided by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd unless otherwise stated. The information is not intended to be advice or a recommendation to buy, sell or hold any of the shares, companies or investment vehicles mentioned, nor is it information meant to be a research recommendation. This is a solution powered by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd incorporating their prices, data news, charts, fundamentals and investor tools on this site. Terms and conditions apply. Prices and trades are provided by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd and are delayed by at least 15 minutes.

Data provided by FE fundinfo. Care has been taken to ensure that the information is correct, but FE fundinfo neither warrants, represents nor guarantees the contents of information, nor does it accept any responsibility for errors, inaccuracies, omissions or any inconsistencies herein. Past performance does not predict future performance, it should not be the main or sole reason for making an investment decision. The value of investments and any income from them can fall as well as rise.

© 2025 Refinitiv, an LSEG business. All rights reserved.