Is NatWest worth banking on now the government has sold its final stake?

Experts explain which UK banks are worth investing in.

- Patrick Sanders

- 5 min reading time

Source: Trustnet

The UK treasury has sold its final shares of NatWest, bringing the UK bank back into full private ownership after it was bailed out during the global financial crisis.

Bank chairman Rick Haythornthwaite described this as a “major inflexion point” and opportunity for the UK business, which was once 84% owned by the government.

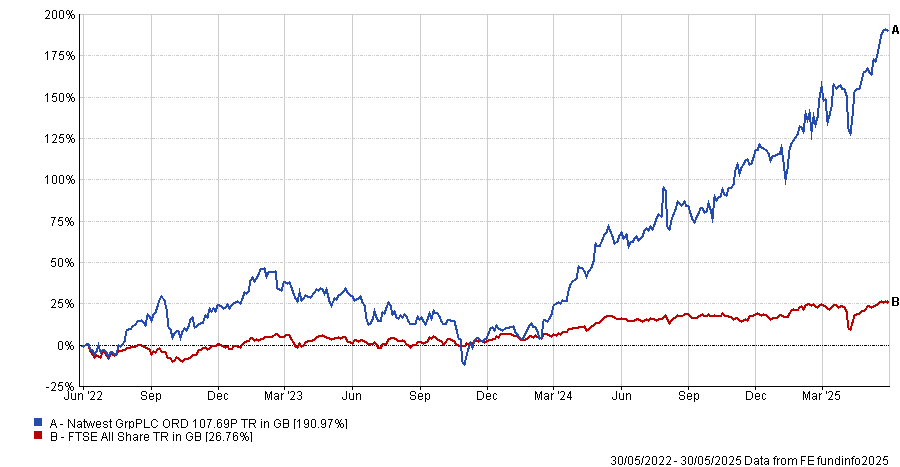

The holding has been prosperous for the government and its other shareholders in recent times, making 191% over three years on a total return basis, significantly outperforming the FTSE All Share, and some asset managers believe the stock can continue to impress.

Total return of NatWest and FTSE All Share over the past 3yrs

Source: FE Analytics

Below, fund managers tell Trustnet whether NatWest can sustain this impressive run or if it might be time to consider other options.

Aegon’s Ahmed – An island of stability

Sajeer Ahmed, investment manager at Aegon Asset Management, said: “Despite strong outperformance versus the FTSE All Share, we remain positive on NatWest.”

While rising interest rates have boosted earnings since 2021, valuations have not caught up. At the time of writing, NatWest trades at a price-to-earnings (P/E) ratio of around 9x, which remains an undemanding multiple. By contrast, the FTSE All Share currently stands at a P/E ratio of around 13.4x.

“Put another way, the stock offers an earnings yield of more than 12%”, he said, which is distributed to shareholders via dividends and share buybacks, and should persist as the business attempts to improve its operational efficiency.

It is also a beneficiary of recent global market uncertainties, he argued. US president Donald Trump’s ‘Liberation Day’ tariffs have increased geopolitical and trade tensions, leading to defensive UK assets such as banks emerging as an “island of relative stability” and a “relative safe haven” over the long term.

“This narrowing risk premium towards UK assets, continued earnings growth, and an attractive distribution profile are all factors that should help to support the positive investment case in NatWest shares”.

Lansdowne’s Davis – Expect stronger returns in the years ahead

NatWest is the largest position in Peter Davis’ Lansdowne Developed Market fund. The co-manager said there were two “basic truths” of banking that investors need to be aware of.

“First, it is an industry that tends to grow at least in line with nominal GDP over time. Second, economies of scale are compelling, both from cost efficiencies and because new business flows tend to be less profitable than the sticky stock of customers, rendering new entrant economics poor”, he told Trustnet.

As a result, while the sector is regaining momentum, more established businesses such as NatWest will be the biggest beneficiaries.

Additionally, they are still heavily underestimated by investors, he explained. Since the global financial crisis, investors have priced “incredibly high risk premiums” into UK banks that are “increasingly hard to validate”. Not only are banks very different businesses than they were in 2008, but the average UK consumer is also in a much healthier position.

Additionally, bank returns have been relatively understated due to banks' tendency to hedge interest rates. If these hedges start to unwind, “we can expect even stronger returns in the years ahead” from businesses such as NatWest.

Man Group’s Barrat – We are looking further down the range

However, not all portfolio managers favoured NatWest. Jack Barrat co-manager of the Man Undervalued Assets fund, said: “The sector as a whole has re-rated in the past year and we are looking further down the range”. The fund includes Barclays and HSBC in its top 10 holdings.

Despite generating significant capital since the global financial crisis, valuations have remained consistently low for a prolonged period, creating a solid foundation for further outperformance.

Additionally, banks have achieved these returns despite loan growths being much lower than historical averages. If loan growth starts to increase, it would only add “another leg to their story.”

“The sustainability of current earnings is increasingly high,” he concluded.

JOHCM’s Beagles – We are on our way to selling out of NatWest completely

While NatWest was formerly one of the largest holdings in the JOHCM UK Equity Income fund, manager Clive Beagles plans to sell out entirely.

“I suspect we are on our way to reducing it to 0%. A year and a half ago shares were about £1.60, now they are more than £5. It is just no longer particularly cheap, and the investment case has played out,” he said.

However, there are plenty of cheaper opportunities in the UK banking sector benefitting from similar tailwinds at much lower costs, such as Barclays, which is “still sitting on the naughty step of valuation metrics”.

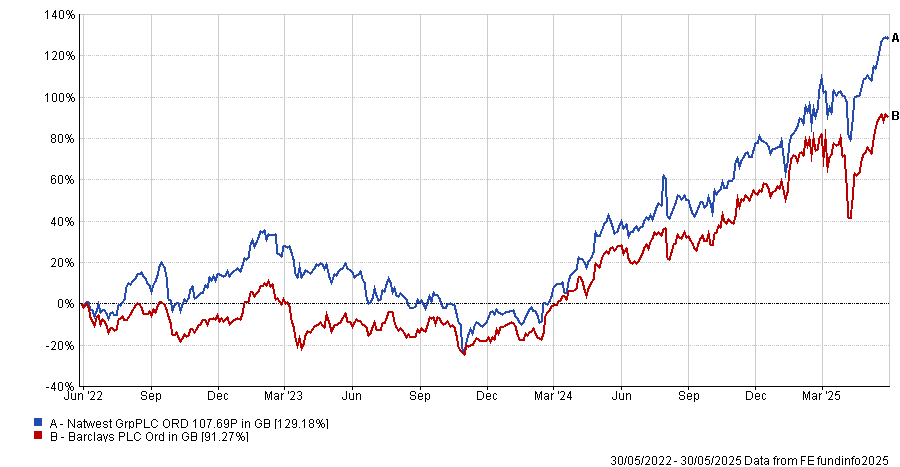

Indeed, while Barclays' share price is up by 90% over the past three years, this is still lower than NatWest, which surged 129.2%.

Share price of NatWest and Barclays over the past 3yrs

Source: FE Analytics

While its return on equity is currently lower than NatWest's, it is planning a range of self-help and restructuring programmes, which will provide a significant tailwind to a business that already offers double-digit returns in share buybacks and dividends.

Regulation, he noted, has become much more favourable in recent years, with banks no longer being regarded as the “old enemy” of the UK market. As a result, there is significant turnaround potential in the more undervalued UK banks, he concluded.

Important legal information

Bank of Scotland Share Dealing Service is operated by Halifax Share Dealing Limited. Halifax Share Dealing Limited. Registered in England and Wales No. 3195646. Registered Office: Trinity Road, Halifax, West Yorkshire HX1 2RG. Authorised and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN under number 183332. A Member of the London Stock Exchange and an HM Revenue & Customs Approved ISA Manager.

The information contained within this website is provided by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd unless otherwise stated. The information is not intended to be advice or a recommendation to buy, sell or hold any of the shares, companies or investment vehicles mentioned, nor is it information meant to be a research recommendation. This is a solution powered by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd incorporating their prices, data news, charts, fundamentals and investor tools on this site. Terms and conditions apply. Prices and trades are provided by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd and are delayed by at least 15 minutes.

Data provided by FE fundinfo. Care has been taken to ensure that the information is correct, but FE fundinfo neither warrants, represents nor guarantees the contents of information, nor does it accept any responsibility for errors, inaccuracies, omissions or any inconsistencies herein. Past performance does not predict future performance, it should not be the main or sole reason for making an investment decision. The value of investments and any income from them can fall as well as rise.

© 2025 Refinitiv, an LSEG business. All rights reserved.