Source: Sharecast

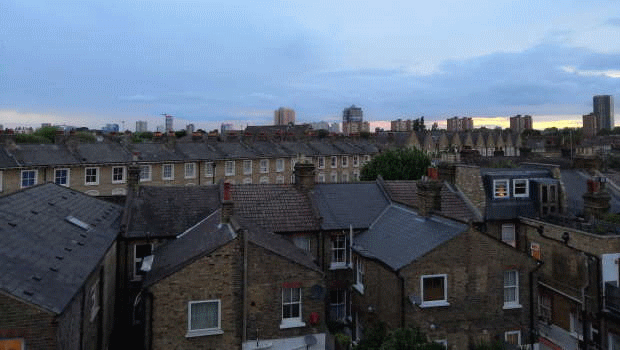

According to Rightmove, average house prices rose just 0.3%, well below the ten-year average for October of 1.1%. Year-on-year, prices dipped 0.1%.

The national average asking price now stands at £371,422.

Autumn traditionally benefits from a spike in demand as the market bounces back from the quieter summer months.

However, after years of constrained supply, the amount of property for sale has rocketed in recent months to a ten-year high, weighing on prices. Some movers are also increasingly cautious about committing to sales ahead of next month’s Budget.

Rightmove’s Colleen Babcock said: "Despite the overall resilience of the 2025 housing market, we’ve not got enough pent-up momentum or recent positive sentiment to spur the autumn bounce in property prices.

"Sellers who are serious about selling have had to acknowledge their limited pricing power and moderate their price expectations.

"In addition, speculation that the Budget may increase the cost of buying or owning a property at the higher end of the market has given some movers, particularly in the south of England, a reason to wait and see what’s announced."

The number of new buyers contacting estate agents about homes for sale, and the number of new sellers coming to market were both down 5% in the full month of September, Rightmove noted.

However, in the year-to-date the market appeared more resilient. Agreed sales are 5% higher year-on-year, while new buyer demand is up 2% and new sellers 5%.