Kopernik soft-closes top-performing Global All-Cap strategy

Kopernik Global Investors will soft-close the strategy on 30 April 2026, while launching a new mid- to large-cap Global Opportunities strategy.

- Gary Jackson

- 2 min reading time

Source: Trustnet

Kopernik Global Investors will soft-close its $8.2bn Global All-Cap strategy on 30 April 2026 after a run of strong performance.

Existing investors who currently hold positions in the Global All-Cap strategy will be able to continue investing additional money. The Global All-Cap Mutual Fund, which soft-closed on 31 July 2025, will not hard close at this time.

Kopernik’s Global All-Cap strategy returned 66.5% in calendar year 2025 while the firm’s International strategy returned 56% over the same period.

In the UK market, the Heptagon Kopernik Global All Cap Equity fund was the fourth best performing fund in the IA Global sector in 2025 with a 63.4% total return. The fund ranks in the sector's top decile over three and five years.

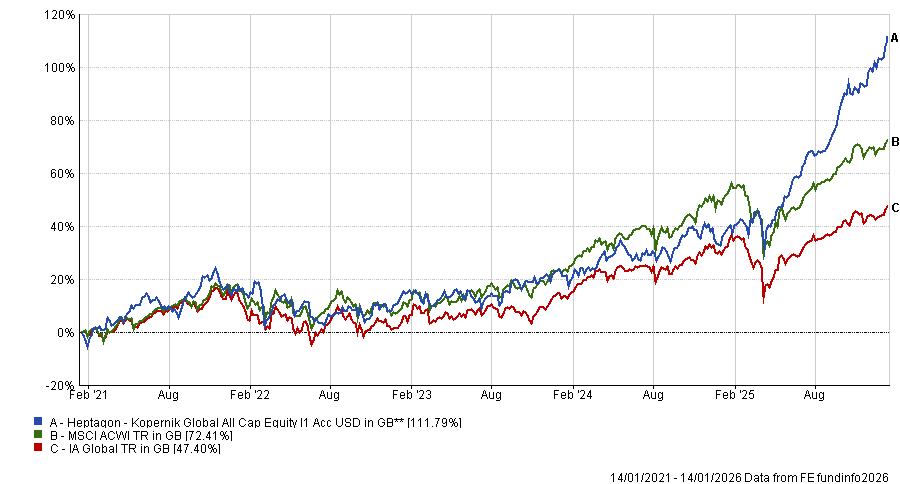

Performance of Heptagon Kopernik Global All Cap Equity vs sector and index over 5yrs

Source: FE Analytics

Heptagon Kopernik Global All Cap Equity is well-liked by fund pickers, having been one of Shard Capital’s choices for bullish investors and highlighted for doing something different to its peers in past Trustnet articles.

Kopernik said in a statement: “After significant consideration, and consistent with our approach of limiting capacity in order to enhance return potential, we have decided to proceed with the soft close of the Kopernik Global All-Cap strategy.”

Kopernik will also launch a Global Opportunities strategy on 30 April 2026,which will invest globally in mid- to large-cap stocks.

Dave Iben and Alissa Corcoran, co-chief investment officers at the deep value investment house, will co-manage the strategy. This is the first launch since Kopernik’s International strategy in 2015.

“Though traditionally, deep value is associated with SMID-cap companies, the Kopernik team continues to take a nuanced approach to determining which companies to invest in and is now finding considerable opportunities in securities with a market capitalisation greater than $3bn,” a representative noted.

Important legal information

Bank of Scotland Share Dealing Service is operated by Halifax Share Dealing Limited. Halifax Share Dealing Limited. Registered in England and Wales No. 3195646. Registered Office: Trinity Road, Halifax, West Yorkshire HX1 2RG. Authorised and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN under number 183332. A Member of the London Stock Exchange and an HM Revenue & Customs Approved ISA Manager.

The information contained within this website is provided by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd unless otherwise stated. The information is not intended to be advice or a recommendation to buy, sell or hold any of the shares, companies or investment vehicles mentioned, nor is it information meant to be a research recommendation. This is a solution powered by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd incorporating their prices, data news, charts, fundamentals and investor tools on this site. Terms and conditions apply. Prices and trades are provided by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd and are delayed by at least 15 minutes.

Data provided by FE fundinfo. Care has been taken to ensure that the information is correct, but FE fundinfo neither warrants, represents nor guarantees the contents of information, nor does it accept any responsibility for errors, inaccuracies, omissions or any inconsistencies herein. Past performance does not predict future performance, it should not be the main or sole reason for making an investment decision. The value of investments and any income from them can fall as well as rise.

© 2026 Refinitiv, an LSEG business. All rights reserved.