The stocks being added to your FTSE 100 and FTSE 250 trackers

Trustnet looks at the companies heading in and out of the major UK indices after the latest rebalance by FTSE Russell.

- Jonathan Jones

- 4 min reading time

Source: Trustnet

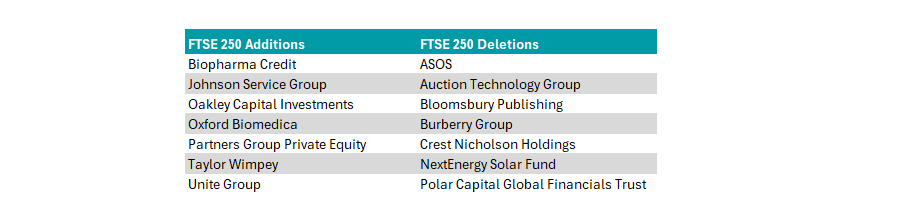

Fashion house Burberry and energy firm Metlen Energy & Metals will join the FTSE 100 following the FTSE Russell’s September 2025 quarterly review, the index provider confirmed on Wednesday evening, replacing housebuilder Taylor Wimpey and student accommodation owner Unite Group.

The reshuffle is a key moment for investors, with companies added to a larger index likely to benefit from passive funds buying shares to match the market weighting. The converse is true for those leaving an index.

Companies are added automatically to the FTSE 100 if they are within the largest 90 names in the UK market, while stocks are automatically removed if they are no longer among the UK's 110 largest listed groups.

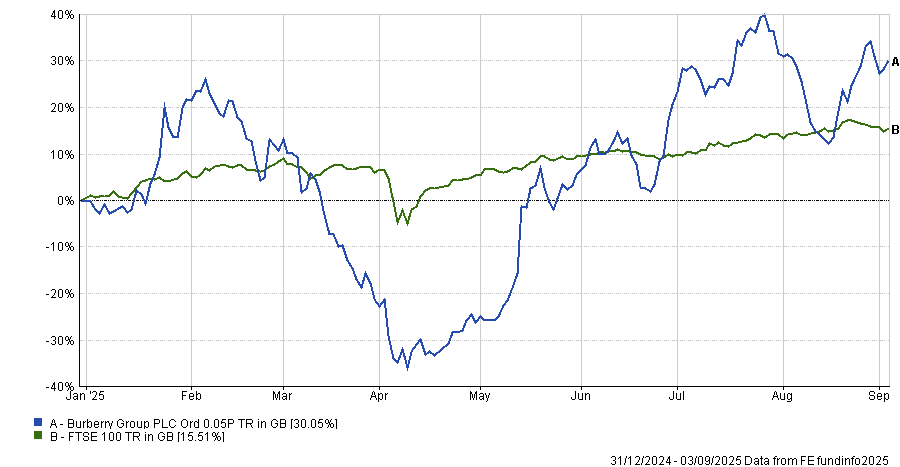

Burberry has been a huge success story this year, with the luxury fashion brand making a total return of 30% so far in 2025, double the return of the FTSE 100.

Performance of Burberry vs FTSE 100 over YTD

Source: FE Analytics

AJ Bell investment analyst Dan Coatsworth noted that shares in Burberry have been rallying since last April as the company works on a turnaround plan.

This follows a “strategic misstep” and a “lacklustre Chinese market”, a region that was once “a golden ticket to big sales”.

In July, the firm noted that it was in the “early stages” of a turnaround, which has included committing to a £40m cost-cutting programme and axing jobs.

Revenues fell by 6% year-on-year to £433m for the quarter ended 28 June as currency impacts hit, but this was a slowdown in declining sales that the market responded positively to.

The company said: “In the first half, we are continuing to prioritise investment and expect to see the impact of our initiatives build as the year progresses.”

Meanwhile, Metlen Energy & Metals launched on the London Stock Exchange last month and has immediately rallied to enter the FTSE 100.

On the out is Taylor Wimpey, which Jemma Slingo, personal finance specialist at Fidelity International, said has had a “challenging start to the year”, which included a recent cut to profit forecasts.

“The state of the property market is partly to blame for its struggles, with high interest rates deterring first-time buyers. However, it has also been hit by some big one-off costs,” she noted.

Further down the market-capitalisation spectrum, online fashion brand ASOS has dropped out of the FTSE 250, which Coatsworth described as a “blow to the company’s reputation”.

“ASOS moved from AIM to the main market in February 2022 with the aim of enhancing its corporate profile and recognition, as well as attracting a broader group of institutional shareholders,” he added.

“At the time, it had an ambitious growth strategy and was determined to bounce back from a post-pandemic hangover, which saw a big slowdown in sales growth across the retail sector. Unfortunately, its struggles have got worse and the shares have limped along. Competition has remained fierce, consumer trends have shifted, and ASOS has been left behind.”

It comes at a difficult time for the retailer, which is attempting to relaunch the brand Topshop, a once beloved high-street fashion chain that ASOS has a 25% stake in.

Source: FTSE Russell

Harry Potter publisher Bloomsbury has also been removed from the mid-cap index. It entered last August as sales of ‘romantasy’ novels, including the hugely popular A Court of Thorns and Roses, turbocharged its profits.

There were also a plethora of investment trusts that moved in and out of the second-largest index. Private equity trusts Oakley Capital Investments and Partners Group Private Equity will both become constituents of the FTSE 250 after strong performance in 2025.

The band for automatic promotion into the FTSE 250 from FTSE Small Cap is 325 or above, while automatic demotion is 376 or below.

Gavin Trodd, analyst at Deutsche Numis, said: “The inclusion into the respective indices is likely to fuel additional demand for the shares, particularly from passive, index-tracking strategies, which may improve both the liquidity in the underlying shares and help to narrow the respective discounts.”

Making way was Polar Capital Global Financials and NextEnergy Solar Fund, which have been relegated to the FTSE Small Cap. RTW Biotech Opportunities will also be added to the minnow index.

Important legal information

Bank of Scotland Share Dealing Service is operated by Halifax Share Dealing Limited. Halifax Share Dealing Limited. Registered in England and Wales No. 3195646. Registered Office: Trinity Road, Halifax, West Yorkshire HX1 2RG. Authorised and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN under number 183332. A Member of the London Stock Exchange and an HM Revenue & Customs Approved ISA Manager.

The information contained within this website is provided by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd unless otherwise stated. The information is not intended to be advice or a recommendation to buy, sell or hold any of the shares, companies or investment vehicles mentioned, nor is it information meant to be a research recommendation. This is a solution powered by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd incorporating their prices, data news, charts, fundamentals and investor tools on this site. Terms and conditions apply. Prices and trades are provided by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd and are delayed by at least 15 minutes.

Data provided by FE fundinfo. Care has been taken to ensure that the information is correct, but FE fundinfo neither warrants, represents nor guarantees the contents of information, nor does it accept any responsibility for errors, inaccuracies, omissions or any inconsistencies herein. Past performance does not predict future performance, it should not be the main or sole reason for making an investment decision. The value of investments and any income from them can fall as well as rise.

© 2025 Refinitiv, an LSEG business. All rights reserved.