‘The element of surprise will be the speed of rate cuts,’ says M&G’s Woolnough

Unsustainable fiscal deficits means that interest rates will have to fall much faster than investors expect, the veteran manager explains.

- Patrick Sanders

- 4 min reading time

Source: Trustnet

Investors are underestimating how many rate cuts will happen this year, according to veteran manager Richard Woolnough.

This month, the Federal Reserve held interest rates at 4.25% to 4.5%. At present, the Fed ‘dot plot’ – a measure of where the committee members believe interest rates will end the year – suggests a range of between 3.5% and 4.5% in 2025. This would imply either no cuts for the remainder of the year, or as many as three.

However, Woolnough told Trustnet last week that the current market environment is akin to the financial crisis of 2008, when rates were “too high for too long” in an attempt “to kill the property bubble”. This time around, rates are too high “to kill the inflation bubble”. This could lead to recession – something many fund managers believe is a strong possibility in 2025.

Woolnough explained recession is hard to predict but noted that the risks of “some kind of economic slowdown” are rising. If recession does occur, however, the manager turned to history as a guide.

In prior recessions, rates generally fell by around 3-4 percentage points, so “if we want to avoid recession in 18 months” we may need more rate cuts than currently predicted.

“If there is a surprise on the horizon, I think it’s that rates have to come down far more rapidly than the market currently thinks”, he said. “Obviously, everyone expects rates to come down this year as people get concerned about world trade and the global economy. But this time something is slightly different.”

The “normal mechanisms of rate cuts” have become distorted, meaning the “element of surprise” this year is how fast and how far rates might need to fall to restore stability.

Part of this is because the other way to avoid recession – increasing public spending – is no longer as effective as it once was, he said.

Budget deficits are now much higher than in past recessions, such as 2020 or the global financial crisis, he explained. For example, the US currently has a fiscal deficit of $1.05trn. This increasing fiscal deficit was cited by the credit rating agency Moody as the reason why it downgraded the US’s credit rating earlier this week.

Matthew Amis, investment director at Aberdeen, added: “The Moody’s downgrade will come as a blow to the US, but it should hardly come as a surprise. Markets don’t need the credit agencies to tell them that US has a debt issue.”

However, high budget deficits are not a US exclusive phenomenon, Woolnough explained. “Whether you are Rachel Reeves, Scott Bessent or a leader in Europe, it’s much harder to pull the budget deficit lever than it ever was in the past, because budget deficits are now too high.”

Because of this, governments are approaching a potential recession with “one hand tied behind their backs” because they cannot increase public spending without causing concerns about their balance sheets.

So, if governments cannot rely on increasing public spending to get the economy moving again, central banks must take a more aggressive approach to cutting interest rates, Woolnough said.

“If the budget lever is not as available as in 2007, the only lever available to pull now is interest rates, and you have to pull it hard."

This is particularly important because interest rates take longer to impact the economy than investors often think. In particular, he argued it often takes up to 18 months for the impact of even major interest rate changes to have a real impact.

As a result, even though some central banks cut rates at recent meetings, he argued that the current monetary policy was still quite restrictive worldwide.

“So, the big question then becomes what the next 18 months will look like for interest rates. Well, given where monetary policy is now, it is not going to be boom time, right?”

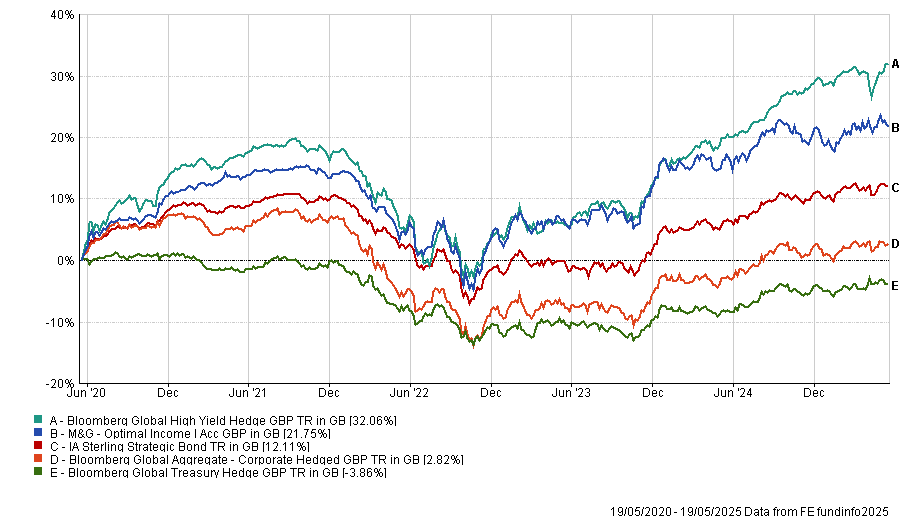

Woolnough has been here before, however. His M&G Optimal Income fund is one of the sector's best-known bond funds, with more than £1.3bn in assets under management. It has delivered top-quartile results in the IA Sterling Strategic Bond sector over the past three and five years.

Performance of the fund vs the sector and benchmark over 5yrs

Source: FE Analytics

During the financial crisis – between 2008 and 2010 – the fund was one of the best performers in its sector, making investors 33.2%.

Important legal information

Bank of Scotland Share Dealing Service is operated by Halifax Share Dealing Limited. Halifax Share Dealing Limited. Registered in England and Wales No. 3195646. Registered Office: Trinity Road, Halifax, West Yorkshire HX1 2RG. Authorised and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN under number 183332. A Member of the London Stock Exchange and an HM Revenue & Customs Approved ISA Manager.

The information contained within this website is provided by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd unless otherwise stated. The information is not intended to be advice or a recommendation to buy, sell or hold any of the shares, companies or investment vehicles mentioned, nor is it information meant to be a research recommendation. This is a solution powered by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd incorporating their prices, data news, charts, fundamentals and investor tools on this site. Terms and conditions apply. Prices and trades are provided by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd and are delayed by at least 15 minutes.

Data provided by FE fundinfo. Care has been taken to ensure that the information is correct, but FE fundinfo neither warrants, represents nor guarantees the contents of information, nor does it accept any responsibility for errors, inaccuracies, omissions or any inconsistencies herein. Past performance does not predict future performance, it should not be the main or sole reason for making an investment decision. The value of investments and any income from them can fall as well as rise.

© 2025 Refinitiv, an LSEG business. All rights reserved.