Savers suffer as fixed bond and cash ISA rates fall

Rates could still appeal however, despite recent drops.

- Jonathan Jones

- 4 min reading time

Source: Trustnet

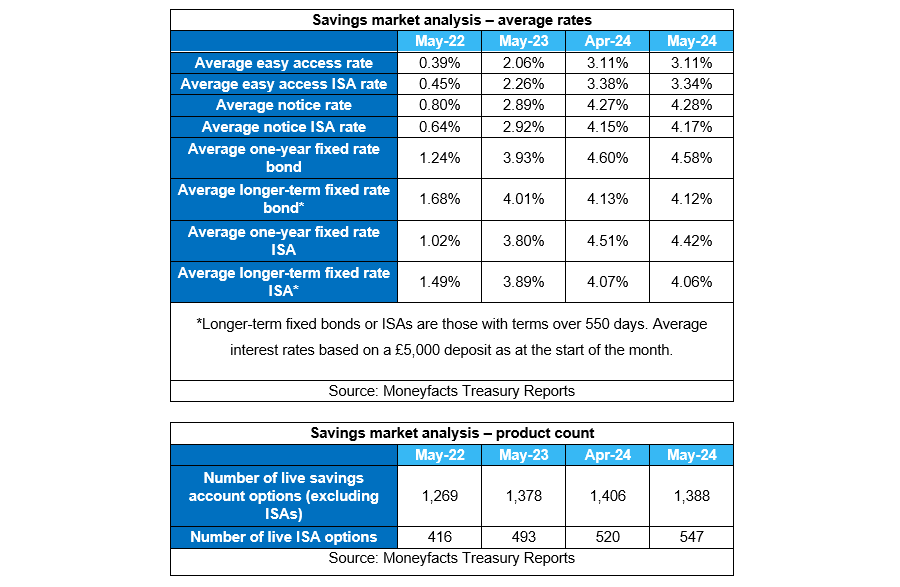

Cash ISA rates have fallen almost across the board this month while the yields from fixed-rate bonds also dropped ahead of expected Bank of England interest rate cuts later this year, new research from Moneyfacts has found.

The average easy access ISA rate fell month-on-month to 3.34% down from 3.38% in April, the first fall since January 2024. Meanwhile the average one-year fixed ISA rate was down to 4.42% from 4.51% and the average longer-term fixed ISA rate slipped 0.01 percentage points to 4.06%, its lowest point since June 2023.

There was a similar trend for non-ISA products too. The average one-year fixed bond fell for a seventh consecutive month to 4.58%, also an 11-month low, while the average longer-term fixed bond nudged 0.01 percentage point lower to 4.12%.

It means the longer-term bond average rate has now dropped by 0.90 percentage points in the past six months. The one-year bond is down 0.78 percentage points over the same timeframe.

Rachel Springall, finance expert at Moneyfacts, said: “It is worth noting that the extent of the latest month-on-month cuts were more subdued than over the past six months. Indeed, between the start of January and February 2024, the average longer-term bond rate fell by a staggering 0.34%, the biggest monthly cut seen in 15 years”.

Despite the cuts, year-on-year fixed bonds are paying much higher rates and “could still appeal to savers hoping to get a guaranteed return on their cash”, she noted.

The falls in rates come despite the amount of products available to savers rising slightly to 1,935, the most on offer since November 2023. This included 547 ISA deals – the most since Moneyfacts began collating the data in 2007.

The number of providers to offer a Cash ISA also rose up from 91 at the start of April to 95 the beginning of May, the biggest month-on-month rise in providers in three years and the highest number in more than 15 years.

“As providers enter the market and improve the availability of products in the aftermath of a busy ISA season, it will be interesting to see whether product choice continues to flourish in the coming months,” said Springall.

It was not all doom and gloom however. The average easy-access rate remained unchanged month-on-month at 3.11%, the first time it has not moved since December. This is positive, said Springall, as last month it experienced its biggest monthly drop since June 2020.

“Savers will still need to proactively check their accounts regularly and switch if they are getting a poor return,” she added.

Variable rates on easy access and notice accounts have also been “generally resilient” in recent months, and year-on-year, are paying more than 1 percentage point more across the board, which includes easy access and notice Cash ISAs.

The average notice rate nudged 0.01 percentage point to 4.28%, the first increase this year. The average notice ISA rate also rose to 4.17%, up from 4.15% in April.

Springall said: “Savers will find a combination of both rises and falls to rates month-on-month, but fixed bond and ISA rates reduced across the spectrum.

“Those coming off a fixed-rate bond would do well to consider the challenger banks which offer some of the best fixed bond rates, enticing deposits to fund their future lending.”

Indeed, based on a £5,000 lump sum, the best easy access savings account rate comes from Ulster Bank, which pays 5.2%, while the top one-year fixed-rate bond from Habib Bank Zurich pays 5.21%. This drops to 4.71% for three-year fixed-rate bonds and 4.57% for five-year bonds, both of which are offered by Shawbrook Bank.

For early-bird ISA savers, Plum offers the top easy-access rate of 5.17%, while Virgin Money has the top one-year rate of 5.06%. For longer fixed periods, again Shawbrook comes out on top, with its 4.41% three-year bond. For the top five-year rate, savers would be best turning to the State Bank of India, which pays 4.15%.

Important legal information

Bank of Scotland Share Dealing Service is operated by Halifax Share Dealing Limited. Halifax Share Dealing Limited. Registered in England and Wales No. 3195646. Registered Office: Trinity Road, Halifax, West Yorkshire HX1 2RG. Authorised and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN under number 183332. A Member of the London Stock Exchange and an HM Revenue & Customs Approved ISA Manager.

The information contained within this website is provided by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd unless otherwise stated. The information is not intended to be advice or a recommendation to buy, sell or hold any of the shares, companies or investment vehicles mentioned, nor is it information meant to be a research recommendation. This is a solution powered by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd incorporating their prices, data news, charts, fundamentals and investor tools on this site. Terms and conditions apply. Prices and trades are provided by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd and are delayed by at least 15 minutes.

Data provided by FE fundinfo. Care has been taken to ensure that the information is correct, but FE fundinfo neither warrants, represents nor guarantees the contents of information, nor does it accept any responsibility for errors, inaccuracies, omissions or any inconsistencies herein. Past performance does not predict future performance, it should not be the main or sole reason for making an investment decision. The value of investments and any income from them can fall as well as rise.

© 2024 Refinitiv, an LSEG business. All rights reserved.